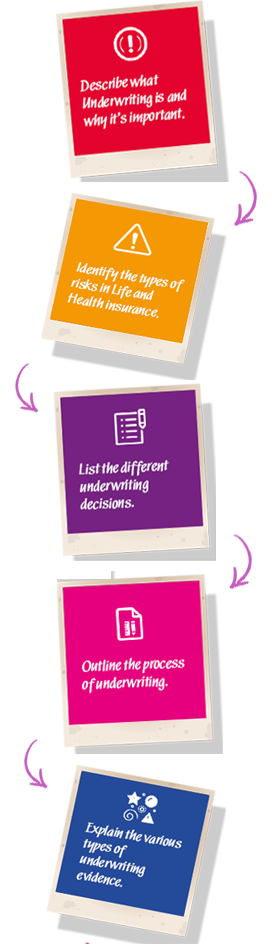

Welcome to this module on

Life and Health

Underwriting

Duration: 5 minutes

This module is audio led.

You can control the audio anytime during the training using the Volume button on each screen within the module.

We recommend you plug in your headphones for a better audio experience.

A transcript is also available on each screen.